Gig economy workers in Houston, especially rideshare drivers, use car title loans as a financial safety net due to their unpredictable earnings. These alternative financing methods leverage vehicle equity for immediate cash access but come with flexible terms and stringent requirements like credit checks. While car title loans offer quick funding, ridesharing provides income flexibility and freedom, making them less suitable for gig economy workers' needs unless carefully considered.

In the dynamic landscape of the gig economy, rideshare drivers seek diverse income streams. As a potential source of funding, car title loans have emerged as an option for those with variable earnings. This article explores whether rideshare earnings can qualify for car title loans, targeting gig economy workers. We dissect eligibility criteria and compare rideshare income maximization against the benefits and drawbacks of car title loans. By understanding these factors, drivers can make informed decisions to navigate their financial journeys effectively.

- Car Title Loans: An Option for Gig Economy Workers?

- Understanding Rideshare Earnings: Eligibility Criteria

- Maximizing Income: Rideshare vs. Car Title Loans

Car Title Loans: An Option for Gig Economy Workers?

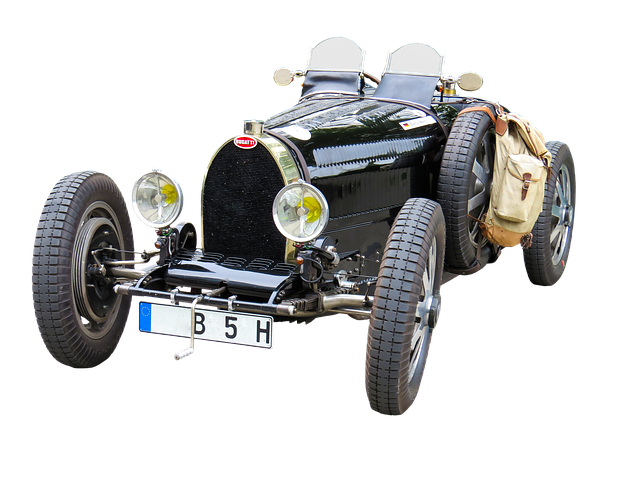

In the dynamic landscape of the gig economy, where individuals often rely on their vehicles to make ends meet, car title loans emerge as a potential financial option for those seeking quick cash. This alternative financing method allows owners of valuable vehicles, such as rideshare drivers, to leverage their vehicle ownership and access immediate funding. Unlike traditional loans that may require stringent eligibility criteria and lengthy application processes, car title loans offer relative simplicity and accessibility, making them an attractive prospect for gig economy workers struggling with financial constraints.

Gig economy workers, including those in the rideshare industry, often face unpredictable income streams and immediate financial needs. Houston title loans, for instance, can provide a much-needed safety net by enabling these workers to refinance existing car loans or secure new funding based on their vehicle’s equity. This option presents itself as a viable solution, especially for individuals who value flexibility and convenience in their financial dealings, offering a potential lifeline within the ever-changing parameters of the gig economy.

Understanding Rideshare Earnings: Eligibility Criteria

In the gig economy, rideshare drivers have become a familiar sight on roads across the nation. These independent contractors earn income by ferrying passengers from point A to B using their personal vehicles. However, when it comes to accessing funding, can their earnings from this sector qualify for car title loans? Understanding the nature of rideshare work is crucial in navigating financial options.

Gig economy workers often face unique challenges when seeking traditional loans due to inconsistent income and a lack of collateral. Car title loans, being secured loans backed by a vehicle’s equity, present an alternative solution. For rideshare drivers, this could mean access to much-needed capital for various purposes, from vehicle maintenance to unexpected expenses. Eligibility criteria typically include proof of income, which in this case, can be demonstrated through records of rideshare earnings. Repayment options vary among lenders, and some may even offer flexible terms tailored to the semi truck loan needs of gig economy workers.

Maximizing Income: Rideshare vs. Car Title Loans

In the gig economy, rideshare drivers are constantly seeking ways to maximize their income. While traditional car title loans might seem like an attractive option for funding, it’s essential to weigh this against the benefits of rideshare earnings. Rideshare platforms offer immediate and flexible earning opportunities, allowing drivers to adapt their schedules and earn based on demand. This dynamic nature sets them apart from car title loans, which typically require a fixed repayment plan and can place a strain on an individual’s cash flow.

Gig economy workers often value the freedom and flexibility of rideshare work. Car title loans, on the other hand, come with stringent requirements, including credit checks, that might not align with the uncertain nature of this line of work. For Houston Title Loans or similar institutions, assessing the stability of earnings can be challenging for drivers who may experience fluctuations in their ride-sharing income. However, for those seeking a rapid financial solution, understanding how rideshare earnings stack up against car title loans is crucial in making informed decisions regarding their vehicle and financial well-being.

Rideshare earnings can provide a flexible income stream for those in the gig economy, but when considering financial options like car title loans, it’s crucial to weigh the benefits and risks. While car title loans may offer quick access to cash, it’s essential to evaluate if maximizing rideshare income through efficient scheduling and strategic driving could be a more sustainable solution for gig economy workers seeking financial flexibility. Ultimately, understanding your earnings potential and making informed decisions can empower you to navigate the financial landscape of the gig economy effectively.